Liability-based liquidity refers to the funding available from sources on a credit union’s balance sheet—for example, member shares, nonmember deposits, and borrowings. Sources that can be relied upon for funding under a broader range of macro and microeconomic conditions are considered more stable and therefore contribute to reducing liquidity risk. The opposite is true for sources of funding considered more volatile.

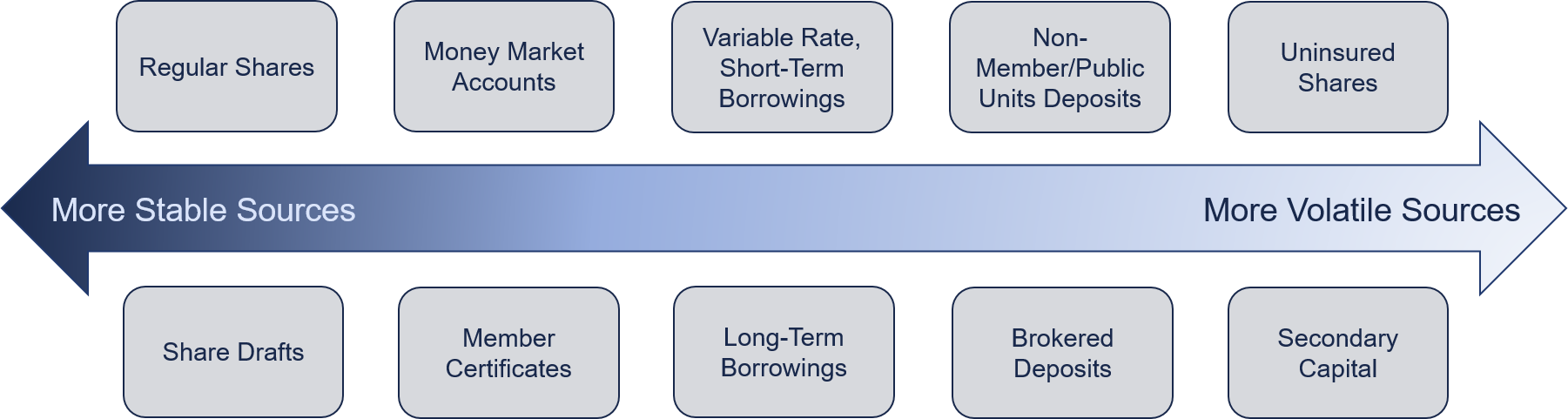

The graphic below illustrates the relative stability of various funding sources dimensioned from most stable to least stable.

Member Shares

Member shares are generally the largest part of credit union funding and are an important, stable source of funds for credit unions. Member shares include:

In many instances, a member's decision to deposit funds in a credit union may be driven by service and relationship factors, not just by the rate of return. Credit unions with a high percentage of regular shares and share drafts typically have a more stable funding base that is less sensitive to changes in market interest rates. Having a stable funding base adds stability to operations, lowers the risk of potential withdrawals, and lowers liquidity risk.

The protection afforded by Share Insurance Fund coverage also provides a significant measure of stability because federally insured depositories are generally viewed as safe havens during periods of market volatility and economic distress. Historically, insured credit unions have experienced inflows of deposits when investors are seeking safe investments. Throughout changing economic and financial market cycles, insured deposits have remained the most reliable funding source.

Historically, transaction accounts—for example, share draft accounts—generally have not experienced high rate sensitivity, because members usually retain these accounts to manage their primary financial needs, such as paying bills. Conversely, money market shares and short-term certificates are more likely to be comprised of discretionary funds, and are therefore considered more volatile shares because there is a higher likelihood of withdrawal or migration to higher paying alternatives.

Securing a significant concentration of funds from a single source—for example, large dollar deposits, member business deposits, and brokered deposits—may represent higher liquidity risk. The loss of a single large deposit can be disruptive and destabilizing when it represents a disproportionate percentage of total deposits. An over-dependence on a single source of funding also undermines the principle of diversification and may give the depositor greater influence over setting the interest rate.

One way a credit union can grow deposits is to offer above market rates. This strategy is not without risks. It can lead to a higher cost of funds and more liquidity risk if the resulting share mix is significantly more volatile in nature. Above market rates attract new members; existing members may switch balances into the new higher-cost share products (share migration). In addition, any new funds generated by high interest rates may prove to be highly rate sensitive. To retain those shares, a credit union may need to match prevailing market rates indefinitely.

Non-interest or operating costs associated with maintaining member shares can also be substantial. Costs associated with generating a large volume of new accounts can include personnel, advertising, and operating costs, as well as the costs associated with branch expansion. Because pricing strategies affect earnings and liquidity risk, examiners look for evidence that a credit union has considered these factors.

Credit unions that offer share certificates typically include early withdrawal penalties that can dissuade members from cashing in share certificates early. Otherwise, in a rising interest rate environment, members may redeem their certificates early to reinvest at a higher rate.

Nonmember Deposits

As a general rule, nonmember deposits are considered a higher-cost alternative with a potentially shorter-term retention when compared to more stable member deposits. Depending on market conditions and relative pricing, nonmember deposits have an increased likelihood of withdrawal when better terms are available elsewhere in the market.

Accordingly, credit unions address the increased costs and higher expected volatility associated with nonmember shares, and monitor as necessary. Failure to mitigate nonmember deposit volatility may result in an unexpected increase in the cost of funds and potential liquidity shortfalls if nonmember depositors withdraw early, or do not renew their shares at maturity.

Concentrations of nonmember deposits could subject a credit union to heightened liquidity demands in uncertain economic times, or if a credit union’s real or perceived creditworthiness deteriorates, especially when the deposit exceeds the insurable amount.

NCUA regulations §§ 701.32, Payment on shares by public units and nonmembers, and 741.204, Maximum public unit and nonmember accounts, and low-income designation, limit the total amount of nonmember and public unit shares for federally insured credit unions to the greater of:

-

50 percent of the net amount of paid-in and unimpaired capital and surplus less any public unit and nonmember shares, as measured at the time of acceptance of each public unit or nonmember shares, or

-

$3 million.

Public Unit Deposits

FCUs and FISCUs, if permitted under state law, may accept nonmember and member deposits from public units, which are defined as “…the United States, any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Panama Canal Zone, any territory or possession of the United States, any county, municipality, or political subdivision or any Indian Tribe.”

In accordance with NCUA regulation § 701.32, Payment on shares by public units and nonmembers, total deposits accepted from public units plus the total of other types of nonmember shares must constitute less than 50 percent of the net amount of PIUCS, less any public unit and nonmember shares. Additionally, when external borrowings are added to nonmember shares plus public unit deposits, a board-approved plan describing how the credit union intends to deploy the funds is required in advance if the total is greater than 70 percent of PIUCS.

Uninsured Shares

Share balances that exceed the NCUA's insured limit (generally, $250,000 per account) are commonly considered more prone to withdrawal, especially during periods of economic stress. These funding sources are considered somewhat volatile because the depositors are more attuned to market rates than other member shares. For more information, see NCUA regulation part 745, Share Insurance and Appendix.

Borrowings

Ideally, credit unions have a specific purpose for entering into a borrowing arrangement and a reasonable plan to repay borrowed funds. Following best practices, management understands all terms of the agreement, such as prepayment penalties and debt covenants. Some of the most common borrowing sources include the FHLBs, corporate credit unions, banks, or other natural person credit unions. Frequent or unplanned borrowing may be evidence of underlying liquidity problems.

FICUs cannot borrow more than 50 percent of PIUCS (that is, shares and undivided earnings, plus net income or minus net loss), per the FCUA § 1757(9) and NCUA regulation § 741.2, Maximum borrowing authority. FISCUs in states that allow higher borrowing limits may request a waiver from their NCUA Regional Director.

A major component of a credit union’s liquidity management is borrowing from market counterparties such as corporate credit unions, correspondent banks, FHLBs, and repurchase agreement counterparties. The ability to borrow from market sources usually requires unencumbered assets being offered as collateral. A credit union’s 1-4 family real estate mortgage portfolio or securities are generally required as collateral for borrowing. Assets pledged to support current borrowings may reduce contingency liquidity options. An unencumbered asset is an asset without any liens or obligations, making them available for a credit union to pledge to secure borrowings.

Larger FICUs with greater potential funding needs are well-served by maintaining multiple stable borrowing sources and a clear understanding of which assets can be pledged. To be successful, these relationships are carefully managed, and the credit union controls the associated funding costs and understands collateral administration.

Subordinated Debt

Effective January 1, 2022, the NCUA Board amended various parts of § 701.34, Designation of low income status, that pertain to secondary capital accounts and added part 702, Subpart D, Subordinated Debt, Grandfathered Secondary Capital, and Regulatory Capital, which includes §§ 702.401–702.414. These new regulations permit LICUs, complex credit unions, and new credit unions to issue Subordinated Debt and receive favorable Regulatory Capital treatment.

Per NCUA regulation § 702.403, Eligibility:

Subject to receiving approval under § 702.408, Preapproval to issue Subordinated Debt, or § 702.409, Preapproval for federally insured, state-chartered credit unions to issue Subordinated Debt, a credit union may issue Subordinated Debt only if, at the time of such issuance, the credit union is:

A complex credit union with a capital classification of at least “undercapitalized,” as defined in § 702.102, Capital classification;

A LICU;

Able to demonstrate to the satisfaction of the NCUA that it reasonably anticipates becoming either a complex credit union meeting the requirements of paragraph (a)(1) of this section or a LICU within 24 months after issuance of the Subordinated Debt Notes; or

A new credit union with Retained Earnings equal to or greater than one percent of assets.

Last updated April 29, 2022