Nonmember Accounts

The FCUA § 1757(6) permits FCUs to accept share deposits (regular shares, share certificates, and share drafts) from other credit unions and both member and nonmember public units. Low-income FCUs may also accept nonmember share deposits from other sources, such as natural persons, foundations, corporations, etc. In accordance with state laws, FISCUs may also accept nonmember deposits as outlined above for FCUs. The acceptance of nonmember deposits does not entitle a nonmember account holder to vote in board of director elections or to receive other services offered by a credit union.

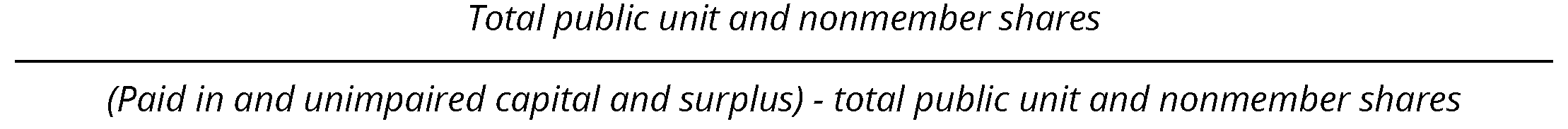

NCUA regulation § 701.32(b), Limitations, permits FICUs to receive up to 50 percent of the net amount of paid-in and unimpaired capital and surplus, less any public unit and nonmember shares or $3 million, whichever is greater.

The formula for calculating the 50 percent limit is below:

A FICU’s board must adopt a specific written plan outlining the intended use of the funds consistent with prudent risk management principles before accepting any public unit or nonmember shares, combined with any borrowings, that exceed 70 percent of paid-in and unimpaired capital and surplus.

NCUA regulation § 741.204, Maximum public unit and nonmember accounts, and low-income designation, applies the requirements of § 701.32, Payment on shares by public units and nonmembers, to FISCUs. However, FISCUs may accept nonmember deposits if permitted by their respective state regulations.

Due Diligence

Nonmember shares are typically volatile and costly, so credit unions should perform a thorough cost/benefit analysis when determining whether to offer shares to nonmembers. In addition, credit unions that offer shares to nonmembers should institute an effective ALM program to monitor and mitigate the risks those shares can present; for example, liquidity and IRR.

Last updated on TBD