Loan Workouts

The NCUA supports the prudent use of loan workouts as an effective tool to assist borrowers struggling to meet their contractual payment obligations. Loan workouts help borrowers overcome temporary financial difficulties including:

- Job loss

- Medical emergency

- Change in family circumstances such as the loss of a family member

A credit union should assist financially distressed members to the extent it is able. NCUA examiners will not criticize a credit union’s efforts to provide prudent relief for borrowers when such efforts are conducted in a reasonable manner with proper controls and management oversight. This approach agrees with the NCUA’s longstanding practice of encouraging credit unions to assist borrowers in times of natural disaster, severe financial disruption, and other extreme events.

The NCUA considers such proactive measures to be in the best interest of credit unions, their members, and the economy. Examiners will assess whether various loan workout programs (modifications, refinances, adjusting due dates, etc.) ultimately improve collectability. This includes a review for potential safety and soundness concerns, such as:

- Masking deteriorations in loan portfolio quality and understating charge-off levels

- Delaying loss recognition resulting in an understated ALLL account and inaccurate loan valuation

- Reporting incorrect levels of TDRs and other loan modifications on the Call Report

- Overstating net income and net worth levels

- Circumventing internal controls

This section addresses the following topics:

- Regulatory Requirements for Loan Workouts

- Loan workout Policy

- Nonaccrual Status

- Troubled Debt Restructured Loans

- Monitoring and Reporting

- CARES Act Provisions

- Accounting for Loan Modifications

- Commercial Loan Risk Ratings

- Consumer Protection

Regulatory Requirements for Loan Workouts

NCUA regulation part 741, Requirements for Insurance, applies to all FICUs. NCUA regulation § 741.3(b)(2) and part 741 Appendix B, Interpretive Ruling and Policy Statement on Loan Workouts, Nonaccrual Policy, and Regulatory Reporting of Troubled Debt Restructured Loans, provide the regulatory framework for loan modification programs.

Loan Workout Policy

While NCUA regulation § 741.3(b)(2) establishes the requirement for a written loan workout policy, and part 741 Appendix B, Interpretive Ruling and Policy Statement on Loan Workouts, Nonaccrual Policy, and Regulatory Reporting of Troubled Debt Restructured Loans, sets forth the required elements of the written policy. Credit union management must adopt and adhere to a written loan workout policy and standards designed to measure, monitor, manage, and control the risk associated with loan workouts.

Examiners should review loan workout policies and practices to confirm they are commensurate with the credit union’s size and complexity, and align with the credit union’s broader risk mitigation strategies. Elements of a written loan workout policy should include:

- Eligibility requirements (under what conditions the credit union will consider a workout).

- Types of loans that may be modified.

- Aggregate program limits (as a percentage of net worth) and limit on the number of times an individual loan may be modified.

- Requirement for loan workout decisions to be based on the borrower's renewed willingness and ability to repay the loan (including supporting documentation).

- Sound internal controls to promote appropriately structured loan workouts.

- Underwriting standards:

- Identify allowable loan modification options (extended amortization period, interest rate reduction, principal forbearance, etc.)

- Update collateral information (condition, value, title search, etc.)

- Verify monthly income and updated credit report

- Identify an affordable debt ratio

- Document thorough analysis of various modification options considered (if reducing the interest rate will not achieve the target debt ratio, consider extending the amortization period – waterfall approach)

- Demonstrate an ability and willingness to repay under the new terms for a period of time before completion of a permanent modification

- Conduct a financial impact analysis for long term mortgage loans (estimate the cost of the credit union concession as measured by an NPV test against the estimated cost of foreclosure or other alternative) NCUA Letter to Credit Unions 09-CU-19, Evaluating Residential Real Estate Mortgage Loan Modification Programs

- Prohibition on additional advances to finance unpaid interest and credit union fees. The credit union may, however, make advances to cover third-party fees, excluding credit union commissions, such as force-placed insurance or property taxes.

- Frequency and responsibility for reporting requirements, including aggregate program limits that will trigger enhanced reporting to the board of directors. This reporting should include information regarding multiple restructurings.

Nonaccrual Status

Consistent with the requirements in NCUA regulation part 741 Appendix B, Interpretive Ruling and Policy Statement on Loan Workouts, Nonaccrual Policy, and Regulatory Reporting of Troubled Debt Restructured Loans, credit unions must recognize income appropriately by placing loans in nonaccrual status. Placing a loan in nonaccrual status does not change the loan agreement or the obligations between the borrower and the credit union. As loan performance deteriorates, the uncertainty of realizing or collecting interest rises. GAAP addresses the various acceptable methods of income recognition in cases of deteriorating credit quality.

Credit unions with $10 million or more in assets must follow GAAP when preparing financial reports. When questions about proper GAAP accounting come up, examiners should encourage credit unions to consult with a licensed independent accountant.

This topic addresses the following subjects:

Requirements

Examiners will assess whether the credit union has the system capability, safeguards, and internal controls to implement the nonaccrual requirements, and if not, assess the adequacy of compensating controls the credit union has implemented to achieve that result.

- All loans should be placed in nonaccrual status when the loan becomes 90 days or more past due in relation to formal contract terms, including both contractual principal and interest, unless the loan is both well secured and in process of collection. Refer to the Accounting for Loan Modifications topic for nonaccrual information on short-term loans.

- Credit unions place loans in nonaccrual status if maintained on a Cash (or Cost Recovery) basis because of deterioration in the financial condition of the borrower, or when payment in full of principal and interest is not expected. GAAP specifies the conditions for use of the Cash (or Cost Recovery) basis. Examiners should verify that:

- Credit unions have a documented accounting policy election and sound process for making this determination

- The credit union’s report of nonaccrual loans includes loans past due 90 or more days as well as any loans maintained on a Cash (or Cost Recovery) basis

- When a loan reaches 90 days past due, previously accrued but uncollected interest should be reversed or charged off. For financial reporting purposes, the previously accrued but uncollected interest cannot be restored (reestablished as a receivable or capitalized in the loan balance) once the loan returns to accrual status. These amounts can only be credited to income if received from the borrower in cash or cash equivalents.

Restoration to Accrual Status

Before returning a nonaccrual loan to accrual status, the credit union should obtain an affirmation of the member’s renewed willingness and ability to make timely payments of principal and interest under the revised contract terms. Below are the regulatory provisions for restoring a nonaccrual loan to accrual status.

- For all loans, other than commercial workout loans, credit unions can return the loan to accrual status when:

- The loan becomes both well secured and in the process of collection

- The past due status is less than 90 days (GAAP does not require the loan be maintained on a cash or cost recovery basis) and the credit union is plausibly assured of repayment of the remaining contractual principal and interest within a reasonable period

- Commercial workout loans may be returned to accrual status if the borrower has demonstrated the ability to make at least six consecutive contractual payments of principal and interest under the restructured terms. In making this determination, the credit union may consider the borrower’s recent repayment performance just before the formal restructuring action.

Application of Payments on Loans on Nonaccrual

For payments received on a nonaccrual loan, the credit union should determine whether to record the payment as a reduction of the principal balance or as interest income. Examiners will evaluate credit union policy electives to determine compliance with GAAP. Key principles to determine payment application compliance are:

- Recognizing income on the cash basis—credit unions may treat some or all of the cash interest payments received as interest income on a cash basis as long as the remaining recorded investment in the loan is deemed fully collectable.

- Applying cash payment to principal—when there is doubt, wholly or partially, for the ultimate collectability of the loan, any payment received will be applied to reduce principal to the extent necessary to eliminate such doubt.

- Recognizing income on the cost recovery basis—the cost recovery basis must be used1 in accordance with GAAP when assets are collectable over an extended period of time and, because of the terms of the transaction or other conditions, there is no reasonable basis for estimating the degree of collectability. Under this method, equal amounts of revenue and expense are recognized as the credit union collects until all costs have been recovered, postponing any recognition of profit until that time. (See FASB ASC 605-10-25-4)

Interest payments applied to reduce the investment in the loan may not be reversed (and interest income must not be credited) while the loan is in nonaccrual status. Accrued but uncollected interest reversed or charged-off at the initial point of nonaccrual cannot be restored even if the loan returns to accrual status; it can only be recognized as income if collected from the member in cash or cash equivalents.

Troubled Debt Restructured Loans

A TDR is defined in GAAP (see FASB ASC 310-40) and requires two conditions:

- The borrower must be experiencing financial difficulty

- The credit union, for economic or legal reasons related to a borrower’s financial difficulties, grants a concession to the borrower that it would not otherwise consider

Examiners should also consider whether the CARES Act provisions related to TDR relief or recent interagency guidance in response to the COVID-19 pandemic are applicable when evaluating loan modifications.

To determine if a workout loan is, or is not, a TDR, the credit union should analyze and document each loan’s fact pattern in accordance with ASC Subtopic 310-40. The credit union should also maintain documentation that clearly supports its conclusion and rationale. Examiners will evaluate credit risk related to all credit union restructure activity that meets GAAP criteria for TDR reporting, regardless of whether the credit union itself or its auditor elect materiality threshold exclusions.

Examiners should review a sample of workout loans for adequate documentation and the credit union’s decision regarding TDR classification. If the credit union fails to sufficiently document its analysis of the TDR conclusion, the examiner should note concerns in the exam report and discuss with management the issues regarding identifying, documenting, and reporting TDRs.

A high degree of judgment is required when analyzing the two elements for a TDR determination—financial difficulty and granting a concession. Examiners will consider the following when reviewing a credit union’s TDR determination.

- Credit union’s application of GAAP in its documentation and conclusions related to financial difficulty and concession determinations. Credit unions may need to consult an independent accountant regarding the appropriate application of GAAP to the loan’s facts and circumstances.

- If a member meets the credit union’s criteria for experiencing financial difficulty, then additional analysis is required to determine whether there is a concession. A restructured loan at a below-market rate would indicate a concession. A restructuring that only results in a delay in payment that is insignificant is not a concession. GAAP provides that the following factors, when considered together, may indicate that a delay in payment is insignificant.

- Amount—The amount of the restructured payments subject to the delay is insignificant relative to the unpaid principal or collateral value of the debt and will result in an insignificant shortfall in the contractual amount due.

- Timing—The delay in timing of the restructured payment period is insignificant relative to any one of the following:

- The frequency of payments due under the debt

- The debt’s original contractual maturity

- The debt’s original expected duration

Monitoring and Reporting

Examiners should assess the credit union’s ability to identify and document any loan that is re-aged, extended, deferred, renewed, or rewritten, including the frequency and extent to which such actions have occurred.

Written policy should address effective risk management and internal controls so that loan workouts can be adequately monitored and reported to the credit union's board of directors and management. The credit union's risk management framework should include thresholds based on aggregate volume of loan workout activity that trigger enhanced reporting to the board of directors.

This reporting will enable the credit union's board of directors to evaluate the effectiveness of the credit union's loan workout program, any implications to the organization's financial condition, and to make any compensating adjustments to the overall business strategy. This information must be made available to the NCUA’s examiners upon request. Refer to NCUA regulation § 741.3(b)(2) for specifics relating to monitoring and reporting requirements.

CARES Act Provisions

A loan modification is an effective way credit unions can assist borrowers who are experiencing financial difficulty due to the effects of COVID-19. A loan modification may involve an interest rate reduction, a longer repayment period, payment deferrals, fee waivers, or any combination of the four. Examiners should not criticize credit unions that engage in loan modifications so long as the credit union mitigates credit risk through safe and sound lending practices.

The NCUA considers such proactive measures to be in the best interest of credit unions, their borrowers, and the economy. This approach is consistent with NCUA’s long-standing practice of encouraging credit unions to assist borrowers in times of natural disaster and other extreme events.

The CARES Act § 4013, Temporary Relief from Troubled Debt Restructurings, provides certain protections for borrowers impacted by COVID-19 and provides guidance for assisting those borrowers. This relief terminates December 31, 2020 or 60 days after the date on which when the COVID-19 national emergency is terminated, whichever occurs earlier.

- Relief from TDR—Credit unions may temporarily suspend the requirement to categorize certain loan modifications related to the COVID-19 pandemic as TDRs.

- Protection from negative credit reporting due to loan accommodations related to the national emergency—Credit unions must report modifications resulting from the COVID-19 pandemic as current or as the status reported before the accommodation unless the consumer becomes current.

Credit unions should maintain records of the volume of loans involved. NCUA will be collecting data about the loans through the Call Report.

The CARES Act § 4022, Foreclosure Moratorium and Consumer Right to Request Forbearance, provides protection for borrowers with single-family mortgage loans who have been financially impacted by COVID-19:

- Forbearance of federally-backed single-family mortgage loans—Up to 180 days of forbearance for borrowers of a federally-backed single-family mortgage loan who experience a financial hardship related to the COVID-19 pandemic. This forbearance may be extended for an additional time period of up to 180 days at the request of the borrower.

The CARES Act § 4023, Forbearance of Residential Mortgage Loan Payments for Multifamily Properties with Federally Backed Loans, provides certain protection for borrowers with multi-family mortgage loans and tenants residing in single- or multi-family properties who have been financially impacted by COVID-19:

- Forbearance of federally-backed multi-family mortgage loans—Up to 90 days of forbearance for borrowers of a federally-backed multiple-family mortgage loan who experience a financial hardship related to the COVID-19 pandemic. Applicable mortgages include loans for real property designed for five or more families. This requirement terminates December 31, 2020 or when the COVID-19 public health emergency is terminated, whichever occurs earlier.

- Protection from eviction—Tenants and homeowners who request a forbearance and reside in single or multiple family properties with government-backed loans cannot be evicted or charged late fees for the duration of the forbearance period.

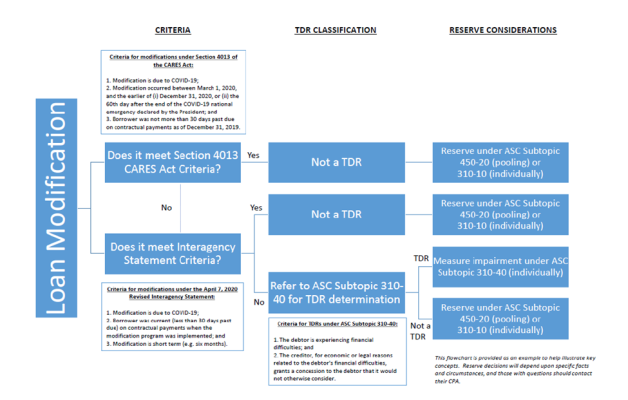

The flowchart below provides a visual representation of the evaluation process for loan modifications under the CARES Act or the April 7, 2020 Revised Interagency Statement. NCUA posted this flow chart on its FAQ page for credit unions.

Accounting for Loan Modifications

The CARES Act 4013, Temporary Relief from Troubled Debt Restructurings, provides credit unions temporary relief from the accounting and reporting requirements for TDRs, specifically:

- Reporting such loans as TDRs in regulatory reports; and

- Determining impairment associated with certain loan concessions (interest rate, payment deferrals, and loan extensions) that would otherwise have been required for TDRs

To be eligible, loan modifications must meet the following criteria:

- The loan modification is due to COVID-19

- The loan was not more than 30 days past due as of December 31, 2019

- The modification occurred between March 01, 2020 and the earlier of December 31, 2020, or 60 days after the national emergency ends

Eligible loan modifications include:

- Forbearance arrangement

- Interest rate change

- Repayment plan

- Any other similar arrangement that defers or delays the payment of principal or interest

The April 2020 Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus (Revised) provides for temporary suspension of TDR requirements if the:

- Loan modification was made due to COVID-19

- Borrower was current (less than 30 days past due)on contractual payments when the modification program was implemented

- Modification is short term (less than 6 months)

For all other loan modifications, credit unions should evaluate whether the modified loan is a TDR. Refer to ASC Subtopic 310-40 for assessing TDR determination. Criteria under ASC Subtopic 310-40 includes:

- The borrower is experiencing financial difficulties

- The credit union, for economic or legal reasons related to the borrower’s financial difficulties, grants a concession to the borrower that is would not otherwise consider

For documentation purposes, credit unions should:

- Retain records of the volume of § 4013, Temporary Relief from Troubled Debt Restructurings, loans as data may be collected for supervisory purposes

- Maintain an appropriate ALLL for allowance for credit losses, as applicable, in accordance with ASC Subtopic 450-20 (loss contingencies) or ASC Subtopic 310-10 (loan impairment)

Commercial Loan Risk Ratings

A loan’s risk rating or classification and its TDR status are separate and distinct decisions. A TDR designation means the loan is impaired for accounting purposes, but it does not automatically result in an adverse classification or credit risk grade. In validating or assigning a credit risk rating, examiners will assess and estimate a loan’s collectability. The assessment should be an analysis of the borrower’s financial condition based on recent and projected performance. In cases where supporting documentation is lacking and future cash flows are uncertain, examiners will rely on the credit union’s assessment of the borrower’s financial condition and ability to repay, along with the sufficiency of collateral support for the loan. Examiners should exercise judgment during these assessments and use existing credit classification standards for loans impacted by COVID-19.

Consumer Protection

When granting loan modifications, credit unions should clearly explain to the borrower how the payments will be handled; providing borrowers with accurate disclosures that are consistent with federal and state consumer protection laws will help to avoid any misunderstandings relative to the changes in the terms.

When working with borrowers, credit unions should adhere to consumer protection requirements, including fair lending laws, to provide the opportunity for all borrowers to benefit from these arrangements. When exercising supervisory and enforcement responsibilities, examiners will take into account the unique circumstances impacting borrowers and credit unions resulting from the National Emergency.

Examiners take into account a credit union’s good-faith efforts demonstrably designed to support consumers and comply with consumer protection laws. Examiner feedback for credit unions will focus on identifying issues, correcting deficiencies, and ensuring appropriate remediation to consumers. Examiners should not take a consumer compliance public enforcement action against a credit union, provided that the circumstances were related to the National Emergency and that the credit union made good faith efforts to support borrowers and comply with the consumer protection requirements, as well as responded to any needed corrective action.

Last updated on June 30, 2020