To manage cash flows and control risk, credit unions:

-

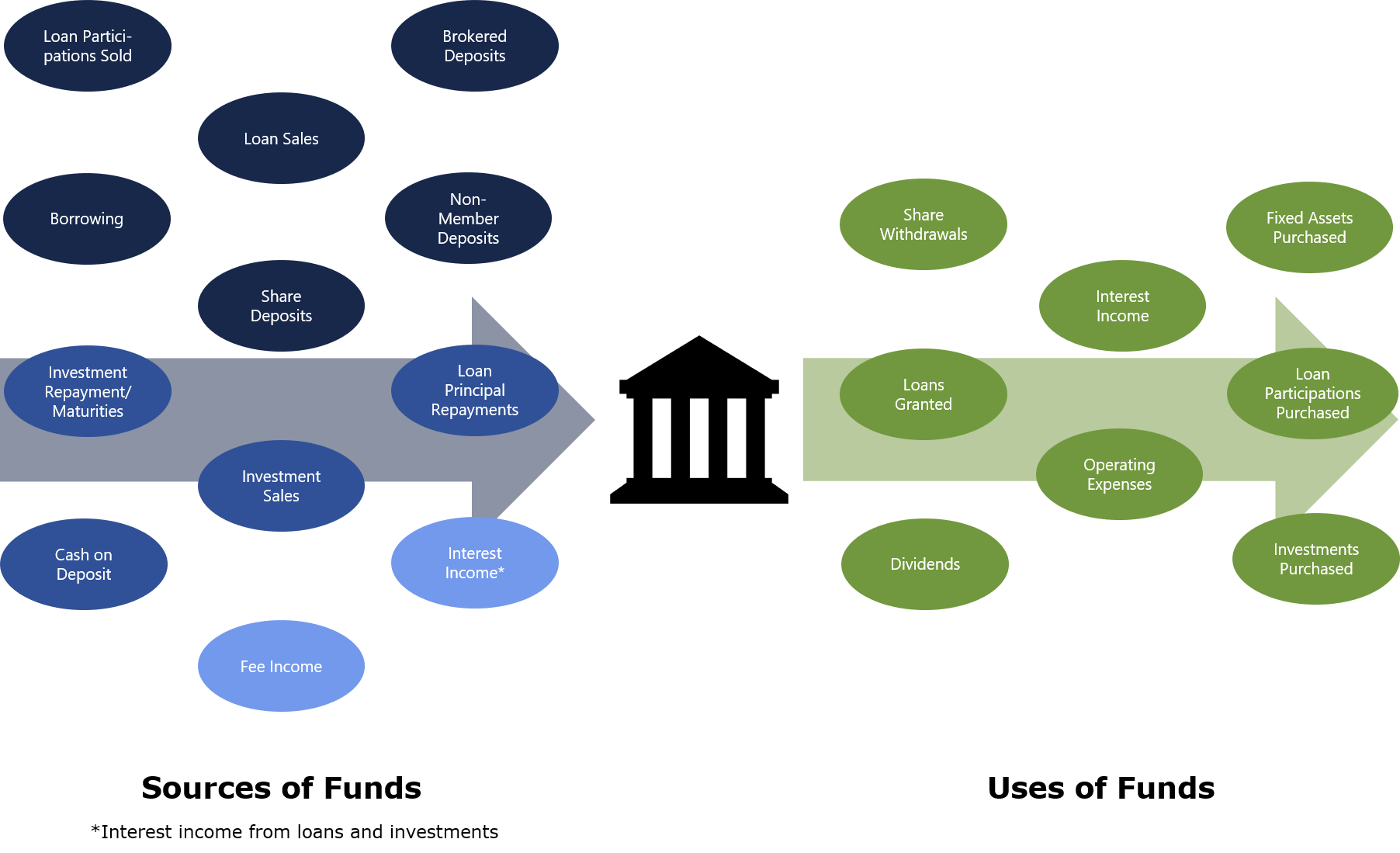

Measure sources and uses of funds

-

Forecast cash flows

-

Plan for changes in business strategy

-

Address liquidity strategy

Credit Union Sources and Uses of Funds

Forecasting Cash Flows

A credit union produces cash flow projections for a variety of scenarios to understand how its funds behave under normal business conditions and the changes that may occur under adverse conditions. Stress testing cash flows helps a credit union predict the impact of adverse conditions on net cash flows and their overall liquidity position.

Cash flow projections can enable a credit union to:

-

Plan for liquidity needs to cover operating expenses, disbursements of new loans, share withdrawals, and repayment of borrowings

-

Make decisions with regard to liquidity excesses or shortfalls

The sophistication of cash flow forecasting ranges from the use of simple spreadsheets to comprehensive liquidity risk models. Some vendors offer ALM models to generate earnings simulations and net economic value measures can also provide options for modeling liquidity cash flows, as both disciplines use a model to capture the amount and timing of all expected cash flows.

The basic purpose of modeling cash flows is to identify circumstances when cash outflows exceed cash inflows and to anticipate the need for a liquidity action ahead of time.

For liquidity modeling, cash flow projections are estimated over the short, medium, and long-term. Credit unions with less complex cash flows and adequate levels of liquidity may forecast short-term positions monthly. Credit unions with more complex cash flows or lower levels of liquidity may need to perform weekly forecasts and monitor transaction accounts daily.

Assumptions

In order to create reliable cash flow projections, credit unions make assumptions related to the sources and uses of funds. Relevant assumptions include:

-

Member behavior

-

Balances of shares and loans

-

Interest rate changes

-

Changes to prepayment speed on loans

Credit unions use current and historical data to establish standard assumptions to forecast normal operating cash flows. Anticipating liquidity risk stemming from funding gaps depends on effectively projecting the use of operational cash flow projections with reasonable and accurate assumptions.

To validate assumptions, management back tests projections to actual results and adjust, as appropriate, to reflect changes in cash flow characteristics. If back testing results indicate that the underlying assumptions may not be reliable, management either adjusts key assumptions (supported by documented rationale) or maintains a higher liquidity cushion. Factors that affect the development of cash flow assumptions include the following:

-

Deteriorating asset quality

-

Highly volatile or unpredictable

-

asset amortization (prepayments)

-

shares and deposits

-

off-balance-sheet commitments (lines or letters of credit)

-

other estimated cash flows

-

-

Unexpected fluctuations in loan demand or deposit balances

-

Adverse performance results due to poor internal management information systems, reporting, and communication

To assess the impact of these factors on funding gaps and cash flow projections, management develops multiple scenarios. Ideally, these scenarios include institution-specific risk—for example, the risk of a credit rating downgrade, market risks such as a market-driven liquidity crisis, and a combination of the two.

Business Strategy Changes

A prudent credit union analyzes the impact of significant new programs or strategies on its cash flows and liquidity. This can be accomplished by incorporating these scenarios into its regular forecast models before implementation. Changes in ongoing business operations may require a credit union to update its liquidity policy. A credit union forecasts cash flow projections if it is considering strategies such as:

-

Offering a high-rate certificate product as an incentive to attract new member shares

-

Borrowing to fund loan growth (such as the FHLB or corporate credit unions)

-

Accepting Uninsured Secondary Capital (LICUs)

-

Soliciting nonmember deposits, public unit, and brokered deposits

-

Increasing operating expenses materially—for example, changes in staff size, new data processing system, change in external vendors

-

Launching a new lending program

Liquidity Strategy

In response to a projected liquidity mismatch (especially when uses of funds exceed sources of funds at a given point in time; a funds shortfall), a credit union develops appropriate strategies and takes corrective action to address adverse conditions and to mitigate liquidity demands. The credit union’s strategy to fund new initiatives accounts for market conditions and available funding options, and complies with the board-approved liquidity policy.

In response to an excess or shortfall of funding, the credit union’s strategy focuses on returning net cash flows to an acceptable level and establishing a sufficient liquidity posture.

Last updated August 30, 2021