The NCUA evaluates a credit union’s IRR exposure because the level of IRR exposure can represent a major potential threat to a credit union’s earnings and capital. When extreme, IRR can present an undue risk to the Share Insurance Fund.

As set forth in Section 201 of the FCU Act and further defined in NCUA regulation § 741.3(d), “undue risk to the NCUSIF” refers to a condition which creates a probability of loss in excess of that normally found in a credit union and which indicates a reasonably foreseeable probability of the credit union becoming insolvent because of such condition, with a resultant claim against the NCUSIF.

In excessive amounts, IRR can threaten a credit union’s financial performance, net worth, and overall safety and soundness. This is particularly true for credit unions with more complex loan, share, and investment products. In severe circumstances, IRR can result in a loss to the Share Insurance Fund, with a greater risk of loss in larger credit unions.

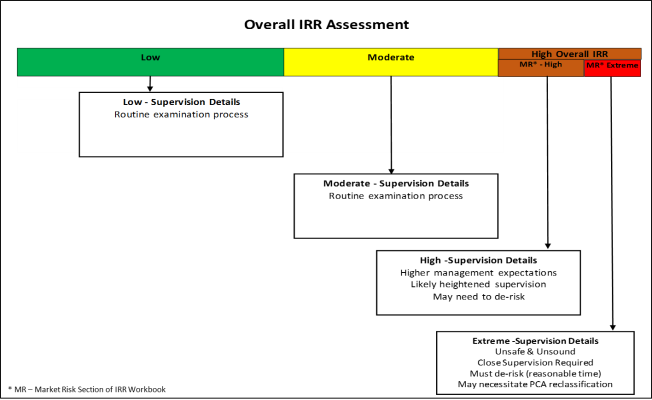

IRR is one of seven risk categories evaluated during the NCUA’s examination process. As part of the NCUA’s supervision procedures, each of these risk areas receive a high, moderate, or low rating.

The NCUA’s IRR rating criteria for the level of market risk incorporates the additional category of extreme in order to clearly delineate the level of IRR exposure (as measured by the NEV Supervisory Test) that it regards to be an undue risk to Share Insurance Fund. Thus, an extreme level of market risk is automatically considered to be an unsafe and unsound condition for which close supervision will be required. (The NEV measurement method is further discussed in the Methods and Processes to Measure and Monitor IRR section of this guide.)

In cases of extreme IRR, supervisory oversight will be executed with increased urgency. The credit union will be required to develop and execute an adequate strategy for reducing its IRR exposure to an acceptable level. This can require “de-risking” its balance sheet through hedging, restructuring and/or asset disposition to keep it below the level of extreme for the foreseeable future, and to do so within a reasonable time. It is expected that instances of extreme market risk will be very rare. Extreme IRR exposure can occur when a credit union’s starting level of capital is significantly lower than the industry average and is coupled with a material amount of IRR exposure. If a credit union fails to adequately de-risk below an extreme exposure level within the agreed upon timeframes, it will likely necessitate administrative actions, including a proposal to the NCUA Board to adjust the credit union’s net worth classification.

If a credit union is not able or willing to adequately de-risk, an NCUA examiner and his/her supervisor should discuss with regional management the need to provide a recommendation to the NCUA Board to reclassify the credit union’s net worth category, based on safety and soundness, as well as to pursue any other applicable enforcement actions to correct the problem (as provided in the existing authority in NCUA regulation § 702.102, Capital classification).

The following figure illustrates the potential supervisory action related to a credit union’s IRR rating. As a credit union’s IRR level increases, supervisory expectations for management increase as well. ("MR" is "market risk.")

The following table is provided in NCUA regulations part 741, Appendix A, Guidance for an Interest Rate Risk Policy and an Effective Program, to assist credit unions in determining the adequacy of their IRR policy and the effectiveness of their program to manage IRR. These guidelines serve as the basis for this section of the Examiner's Guide and the IRR Exam Procedures workbook.

| Policy | |

|---|---|

| Board oversight | Policy is consistent with credit union strategy and balance sheet complexity, clearly defines board risk tolerances through reasonable interest rate risk limits, and states actions required to address policy exceptions. |

| Responsible parties identified | A committee or individual(s) is designated as being responsible for IRR management activities, including review and monitoring of IRR. |

| Direct appropriate action to measure, monitor, and control IRR | Policy states all actions that are sufficient to manage IRR, including measurement and monitoring methods, and interest rate risk reduction alternatives. |

| Reporting frequency specified | Reporting of results is required with sufficient frequency and detail to alert management to emerging IRR. |

| Risk limits stated with appropriate measures | Clearly defined risk limits are established and are appropriate for the size and complexity of the credit union. |

| Tests for limits | Tests substantially display the level and range of credit union IRR. |

| Review of material IRR changes | Any changes beyond a stated level are reported to management and, where appropriate, the Board. |

| Impact of new business | IRR impact of all business initiatives (new products, pricing changes) is required where these will affect future IRR. |

| Periodic policy review | Review by Board required at least annually to ensure continued relevance and applicability of policy to management of IRR. |

| IRR Oversight and Management | |

| Oversight | Board approves policy and strategies and understands IRR faced by its own credit union. |

| Oversight assessment of program effectiveness | Board periodically evaluates program effectiveness by monitoring management's IRR knowledge. Use of third-party professional advice is acceptable, but does not absolve the Board of its responsibility for informed and knowledgeable oversight and governance. |

| Choice of IRR measurement systems | Management selects and maintains systems that are able to capture the complexity of IRR risks. The systems used by the credit union must be able to capture IRR (for example, balance sheet contains material options in investments, mortgage loans, or core deposits - calls, prepayments, or administered rates). |

| Evaluation of IRR risk exposures | Credit union understands all material IRR exposures and evaluates these accordingly relative to credit union strategy. If management relies on outside parties to evaluate credit union's IRR, it must be able to explain the IRR measurement method or the results. |

| System of internal controls | Internal controls encompass and effectively evaluate programs that manage elements of IRR at the credit union. Internal audit has addressed the correction of IRR deficiencies (for example, processes for tracking changes in measurement assumptions, such as repricing of core deposits). |

| IRR resource management | Credit union has allocated initial or additional qualified staff resources sufficient to properly measure and manage IRR by means that address sources of risk. |

| Expertise of IRR program staff | Staff responsible for IRR measurement and monitoring correctly identifies sources of IRR and can quantify those risks, and is knowledgeable about the operation and limitations of the IRR model, even if modeling is performed by a third-party vendor. |

| Procedures and assumptions of IRR measurement systems | Credit union identifies reasonable procedures and is responsible for supportable assumptions, even if modeling is performed by a third-party vendor. |

| Accountability of IRR management | Responsibility for managing IRR is specific and clearly delineated. |

| Transparency of changes in assumptions, methods, and IRR tests | Management requires clear disclosure of relevant changes in all material assumptions and methods. |

| IRR Measurement and Monitoring | |

| Reasonable and supportable assumptions | Credit union carefully evaluates all assumptions and assesses the sensitivity of results relative to each key assumption. Key assumptions should be demonstrated to be supportable (for example, mortgage prepayments capture contraction and extension risk and core deposit premiums indicate reasonable maturities). |

| Assumption changes from observed information | All material changes in assumptions are based on tested internal data or reliable industry sources. |

| Rigor of calculations and conformity of concepts | Techniques used appropriately capture complexity of balance sheet instruments. Methods to attribute cash flows and rate sensitivities are based on correct techniques (for example, proper use of statistical correlations). |

| Position with uncertain maturities, rates, and cash flows | Activity is monitored on a regular basis and compared to projected behavior in order to validate reasonableness of modeling assumptions. |

| Rigor of interest rate measures and tests | Measures and tests employed capture the material risks embedded in the credit union's balance sheet (for example, rate shocks trigger the embedded options in some products). |

| Components of IRR Measurement Methods | |

| Chart of accounts | A sufficient number of accounts have been defined to capture key IRR characteristics inherent within each product (for example, 15- and 30-year fixed-rate mortgages are modeled separately in order to capture various coupons and prepayment behaviors). |

| Data aggregation | The level of data disaggregation is sufficient given the credit union's complexity and risk exposure (for example, instrument level processing). |

| Account attributes | Account setup is appropriate to allow for the capture of key IRR characteristics (for example, adjustable-rate mortgages are modeled with periodic and lifetime caps and floors). |

| Discounting methodology | Methodology used properly calculates the value of the asset or liability being modeled (for example, discount rates or maturities or cash flows are accurate and appropriate in discounting calculations). |

| Assumptions | Credit union carefully evaluates all assumptions and assesses the sensitivity of results relative to each key assumption (for example, mortgage prepayments reflect contraction and extension risk and core deposit premiums indicate reasonable maturities). |

| Internal Controls | |

| Internal assessment of IRR program | Staff is identified and have annually assessed policy and program to correct any weaknesses. |

| Compliance with policy | IRR program is evaluated semi-annually for any policy exceptions, including compliance with approved limits. |

| Timeliness and accuracy of reports | Reports that are routinely provided to management and the Board successfully communicate material IRR exposure of the credit union. |

| Audit findings reported to Board or supervisory committee | IRR program deficiencies and policy exceptions are report to the Board in accordance with the policy. |

| Decision-making and IRR | |

| Use of IRR measurement results in operational decisions | Measured IRR results form part of the credit union's ongoing business decisions and are substantive considerations routinely included in the business decision process. |

| Escalated use of results when IRR exposure is raised or approaching limits | Procedure specifies review escalation at specific levels with increasing contingency triggers close to limits. |

| Application to reduce elevated levels of IRR | Credit union uses IRR results to clearly define and formulate response (balance sheet structure, funding or pricing strategies) to increased IRR levels. |

Workpapers & Resources

- NCUA regulation part 741, Requirements for Insurance

Last updated October 14, 2021